In a world where sustainability is not only a PR buzzword, but with soaring energy prices, has become a necessity – businesses are increasingly embracing renewable energy solutions to power their operations. Among these solutions, solar power stands tall. It harnesses the abundant energy of the sun and reduces your carbon footprint.

For businesses considering solar panel installations, the prospect of going green can sometimes be a challenging one, financially.

The good news is, there is financial support available for businesses that want to invest in solar. We have written before about government grants available for solar. Solar PPAs and solar loans are also options to lighten the initial investment load. But in this blog post we’re going to talk about Large-scale Generation Certificates (LGCs). We’ll explain what they are, how they work and which businesses are eligible for them.

If you run or own a business with a large property, this blog post should help clarify whether LGCs are suitable for your business and if they’re an option you can consider when installing your solar energy system.

So, let’s start at the beginning…

What are Large-scale Generation Certificates (LGCs)?

LGCs are tradable financial certificates designed to incentivise and reward the generation of renewable energy from large-scale sources, such as commercial solar panel installations. The Commonwealth Government offers LGCs as part of its renewable energy target scheme.

You may have heard of STCs (small-scale technology certificates). They’re more common, as they apply to homes and small businesses that install solar. They offer a smaller rebate for smaller solar energy system installations of less than 100kW capacity.

The purpose of incentives like LGCs and STCs are to support the growth of renewable energy generation and encourage the transition to a cleaner, more sustainable energy mix.

So, how do they work?

Get a solar quote for your business

How do Large-scale Generation Certificates (LGCs) work?

LGCs operate within a market-based system, where renewable energy generators are granted a certain number of certificates based on their actual generation of electricity from eligible renewable sources.

Utilising the financial incentives from LGCs can be complicated. If you take advantage of LGCs you are recognized as a ‘power station’. Your energy generation will regularly produce LGCs. This means that the financial incentive is a long-term investment and does not have an immediate payout.

There is no immediate rebate or subsidy accessible upon purchase. LGC incentives are earned over several years, based on te amount of energy generated in each period.

The incentive you receive depends on the amount of energy your system generates – for every 1 megawatt-hour (MWh), you earn 1 LGC. Once LGCs are registered by the Clean Energy Regulator, they become available to trade in the energy certificate trading market.

We have a handy chart and some more information available here.

Who buys Large-scale Generation Certificates (LGCs)?

LGCs are typically purchased by electricity retailers, large energy users, and other entities that have obligations under the Renewable Energy Target (RET) scheme. They are required to procure and surrender an allocated volume of LGCs to the Commonwealth Government each quarter. They purchase them from generators of renewable energy and under this scheme, if you have installed a solar energy system 100kW, or larger, you would be classified as a ‘power station’ and eligible to trade certificates to these liable entities.

Get a solar quote for your business

What is the Value of an LGC?

The value of an LGC and the price you could expect to receive per certificate depends on the market.

The Clean Energy Regulator has information on how to trade LGCs for your business here.

Are Large-scale Generation Certificates (LGCs) right for your solar energy installation?

This is a big decision to make. If you opt for a solar energy system that is larger than 100kW, the decision is made for you. You become ineligible for STCs, with LGCs as your only option.

If you don’t have the cashflow available to install a solar energy system, then LGCs might not be a suitable option. STCs provide immediate funding for the installation.

“STCs provide an upfront rebate through SRES. These are equal to approximately $370 per kW of solar you install.

Example: 99,9kW = 370 x 99.9 = $36,630” (source)

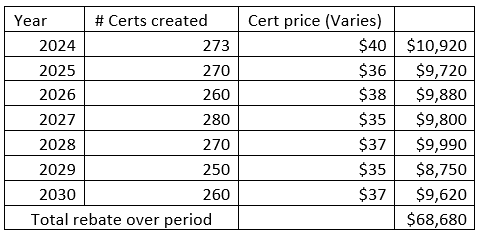

However, if you have a large business or property and expect to generate hundreds of certificates you could be looking at rebates of over $50k, spanning a period of years.

The figures need to be considered.

If you’re unsure and need help assessing which financial incentive your business would get the most from, our solar experts can help.

Get a solar quote for your business

LGCs are a great option for businesses with large installation space. If your business has high energy demands and a lot of space, LGCs could be a very valuable decision, one that will pay itself back over time and then provide additional financial value to your business.

It’s a complex process and we’re happy to talk through the options for your business.

Highlights

What are Large-scale Generation Certificates (LGCs)?

LGCs are tradable financial certificates designed to incentivise and reward the generation of renewable energy from large-scale sources, such as commercial solar panel installations.

How do Large-scale Generation Certificates (LGCs) work?

LGCs operate within a market-based system, where renewable energy generators are granted a certain number of certificates based on their actual generation of electricity from eligible renewable sources. The incentive you receive depends on the amount of energy your system generates – for every 1 megawatt-hour (MWh), you earn 1 LGC. Once LGCs are registered by the Clean Energy Regulator, they become available to trade in the energy certificate trading market.

Who buys Large-scale Generation Certificates (LGCs)?

LGCs are typically purchased by electricity retailers, large energy users, and other entities that have obligations under the Renewable Energy Target (RET) scheme. They are required to procure and surrender an allocated volume of LGCs to the Commonwealth Government each quarter.

What is the Value of an LGC?

The value of an LGC and the price you could expect to receive per certificate depends on the market.

Are Large-scale Generation Certificates (LGCs) right for my solar energy installation?

LGCs are a great option for businesses with large installation space. If your business has high energy demands and a lot of space, LGCs could be a very valuable decision, one that will pay itself back over time and then provide additional financial value to your business. If you opt for a solar energy system that is larger than 100kW, the decision is made for you. You become ineligible for STCs, with LGCs as your only option.